Being a landlord means navigating risks, responsibilities, and the ever-important task of safeguarding your property investment. One of the most overlooked—but incredibly important—steps you can take is adding your property manager as an additional insured on your landlord insurance policy.

This simple move can protect you from unexpected legal and financial headaches and ensure your property manager is properly covered while acting on your behalf. Here’s everything you need to know to make smart, informed insurance decisions.

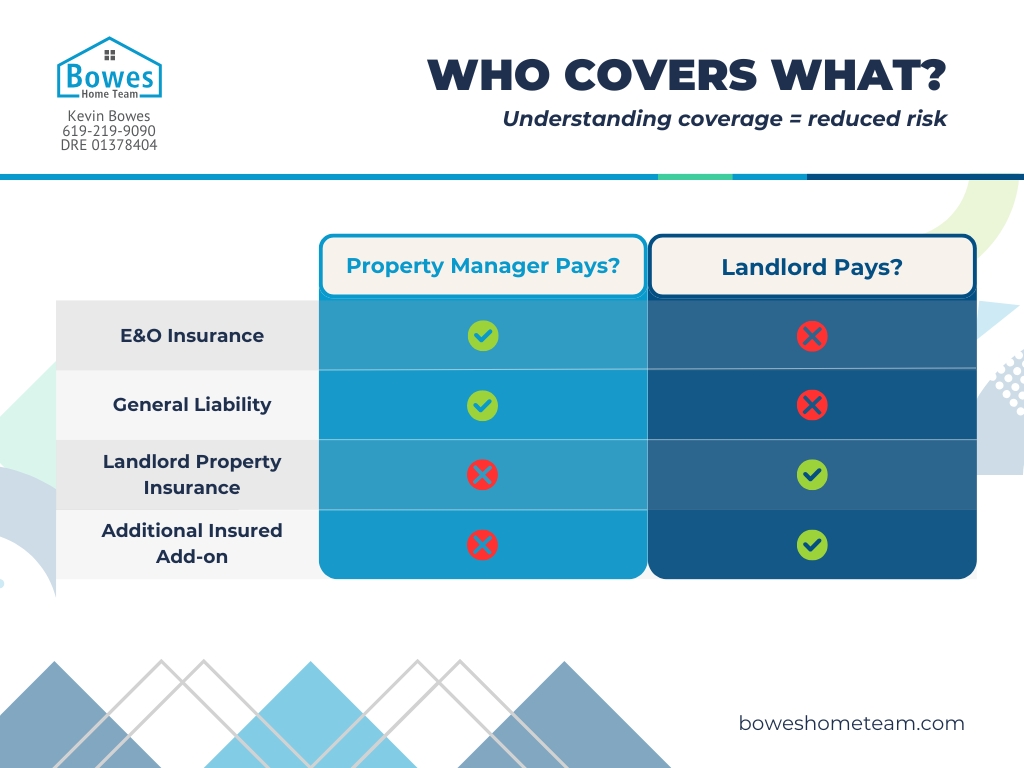

Before discussing your own policy, it’s essential to understand what kind of insurance your property manager should already have:

Important: E&O covers professional errors, while General Liability covers physical incidents. Your property manager should carry both for full coverage.

While property managers have their own policies, they don’t cover everything. Specifically, they do not protect against claims tied directly to your property, like:

When you list your manager as an additional insured, you’re extending your landlord insurance protections to them. This shields them from property-related claims, which could otherwise bounce back to you or expose them to liability without coverage.

Real-World Example:

A tenant trips on a broken step and sues. Even though your property manager handles day-to-day operations, your policy gets triggered. If they’re not listed, their legal defense might come out of their own pocket—or worse, your relationship could sour under pressure.

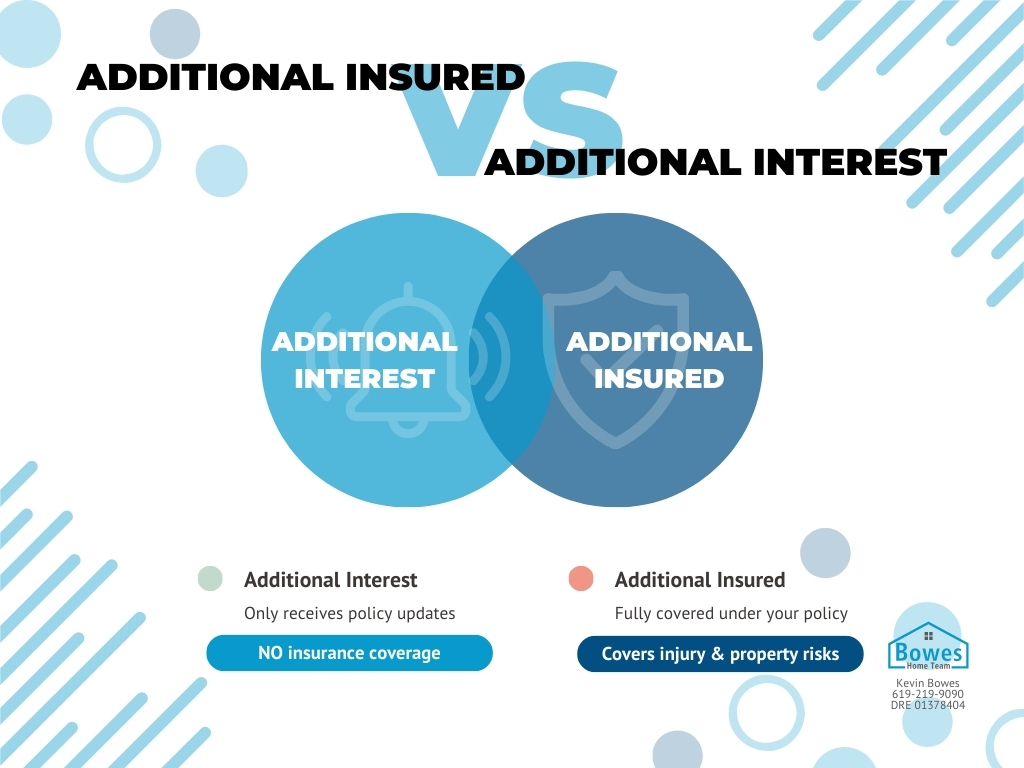

Insurance companies often use similar-sounding terms with very different implications.

| Term | What It Means | What It Covers |

| Additional Interest | Your manager is notified of policy changes or cancellations. | No actual coverage. |

| Additional Insured | Your manager is legally protected under your policy for property-related claims. | Full coverage extension. |

Always ask your insurer to list your property manager as an “Additional Insured.”

Pro Tip: Most property management companies will not pay this fee. It’s generally the landlord’s responsibility.

Here’s a quick checklist to guide your conversation with your insurance provider:

Protecting your rental property goes beyond collecting rent and screening tenants—it also means ensuring your partners are protected. By adding your property manager as an additional insured, you protect yourself from legal liabilities and establish a professional, mutually beneficial working relationship.

Talk to your insurance agent today. That simple conversation could save you thousands in legal fees and property losses.

“Additional interest” means the manager gets notifications, but no coverage. “Additional insured” extends liability protection to the manager under your policy.

Sometimes. Some insurance providers charge a small fee, while others include it at no additional cost.

It’s your insurance policy, and only the policyholder (the landlord) can authorize and pay for changes like this.

Typically, the change is minimal or non-existent, but confirm with your provider.

Claims like tenant injury, property damage, or theft—anything that could arise from incidents on your property.

No. Some companies don’t allow adding third parties as insureds. Be sure to confirm before purchasing a policy.

Not usually, but many property managers require it as part of their agreement.