San Diego has long been a favorite for tourists, professionals, and real estate investors alike—but in 2025, it’s more than just a sunny destination. With population growth, a robust job market, and limited housing supply, San Diego is increasingly seen as one of the best places in the U.S. to own rental property.

But what exactly makes this coastal city such a powerful magnet for renters and property investors?

Let’s break down the top reasons—and what they mean for your investment strategy.

What’s driving the demand?

Why it matters: For property owners, this means:

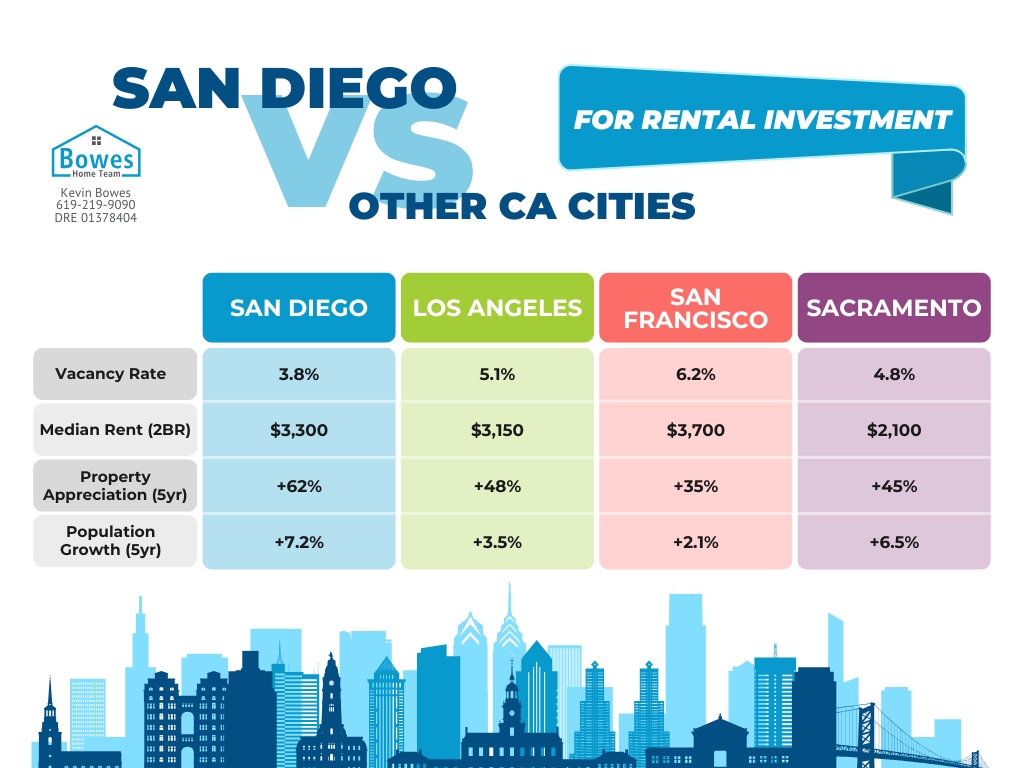

According to recent data, vacancy rates in San Diego hover around 3–4%, well below the national average.

San Diego’s economy isn’t just growing—it’s diversifying, and that’s a good thing for landlords.

Major employment sectors:

Many of these industries attract high-earning professionals who prefer renting near urban centers like Downtown, La Jolla, and University City.

Pro Tip: Properties near biotech hubs or startup clusters tend to attract long-term renters seeking both convenience and lifestyle.

300+ sunny days a year, world-class beaches, thriving arts and food scenes—San Diego sells itself.

Top lifestyle drivers:

This leads to:

San Diego isn’t one-size-fits-all. Its rental inventory suits a variety of investor goals and tenant profiles.

Rental Property Types:

| Type | Ideal Tenant | Investment Benefit |

| Beachfront condos | Tourists, short-term renters | High nightly rates |

| Multi-family units | Working professionals, families | Reliable cash flow |

| Single-family homes | Long-term tenants, families | Appreciation potential |

| Student housing | College students near SDSU or UCSD | Consistent demand, especially in fall |

While San Diego isn’t cheap, its property appreciation is strong and steady.

Investors benefit from:

For buy-and-hold investors, San Diego offers both monthly cash flow and long-term wealth building.

Despite rising purchase prices, rental property owners are well-positioned due to:

This imbalance supports:

San Diego continues to be a top-tier rental market, backed by:

Whether you’re a seasoned investor or just starting out, the data speaks for itself—San Diego is one of the best places to buy and hold rental property in 2025.

A combination of high demand, limited housing supply, and consistent job growth make it ideal for both short-term income and long-term gains.

Look at North Park, Hillcrest, University Heights, and Mission Valley for solid returns and low vacancy rates.

Multi-family units and single-family homes near business hubs or beaches tend to yield the highest returns.

Yes, especially in beach communities like Pacific Beach, Ocean Beach, and Mission Beach—but be sure to check local short-term rental regulations.

Yes, home values have appreciated steadily, with rental income keeping pace due to ongoing demand.